Contribute to an Illinois 529 plan this month and you can cut up to $990 from your 2025 Illinois income tax while landing $10,000 ($20,000 for joint filers) in a child’s college fund—all with one transfer.

This guide covers five concrete moves: 1) open a Bright Start or Bright Directions account, 2) hit the $10k / $20k deduction cap every calendar year, 3) front-load contributions with the five-year “superfund” election, 4) invite family members to pitch in, and 5) roll unused dollars into a Roth IRA—so you wrap everything up before December 31.

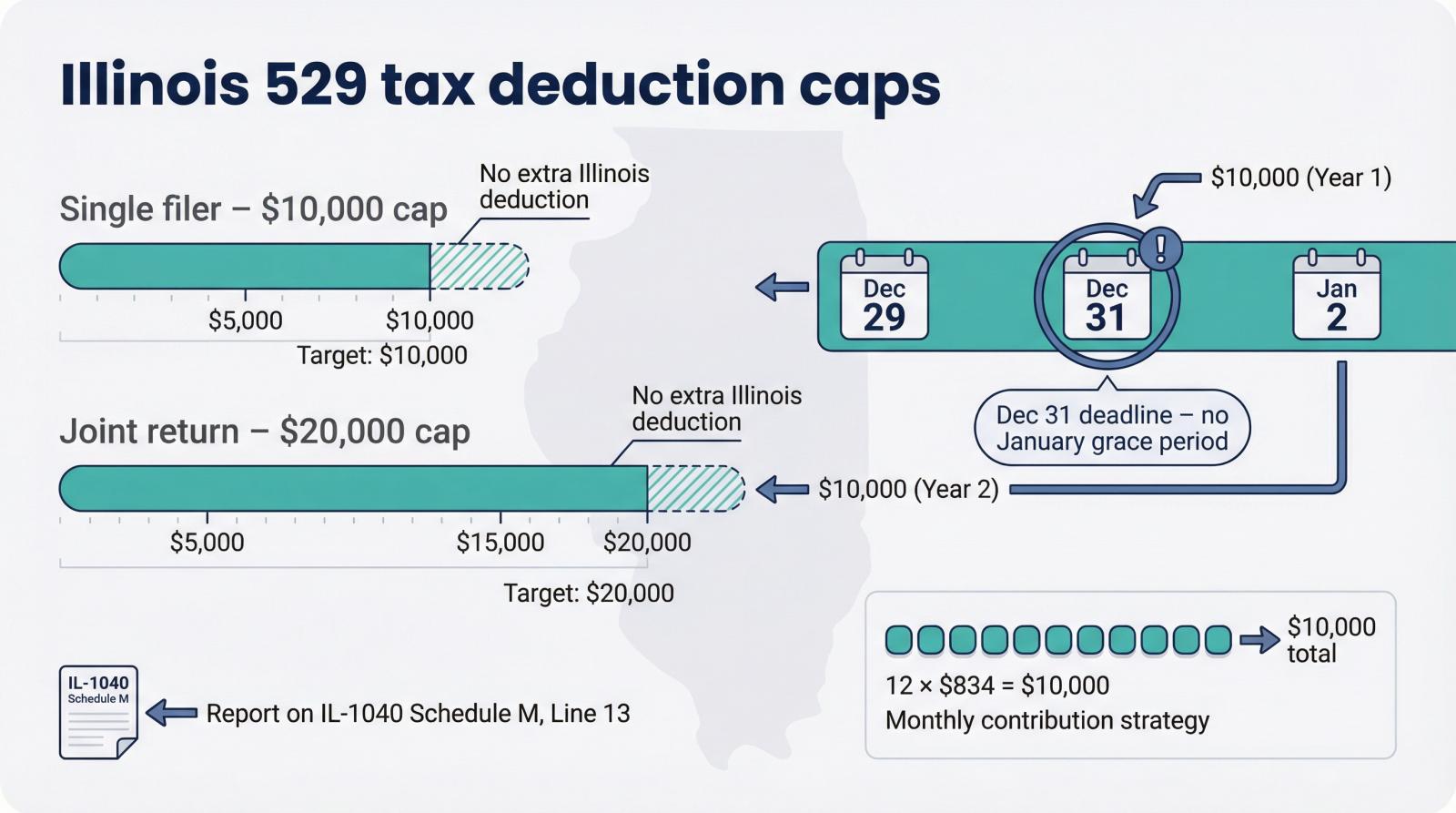

Smart way #2 – hit the $10,000 / $20,000 cap every year

Illinois lets you subtract up to $10,000 if you file solo, or $20,000 on a joint return, for Bright Start or Bright Directions contributions made in the calendar year (tax.illinois.gov). Treat that number as a yearly checkpoint, not a casual target. According to Bright Start 529’s Illinois tax deduction summary, the $10,000 or $20,000 limit applies to your combined contributions to Bright Start, Bright Directions, and College Illinois for the year, regardless of how many accounts or beneficiaries you have. For example, if you are a single filer and put $6,000 into each of two Illinois 529 accounts, you have contributed $12,000 but can only deduct $10,000, so you need to total all of your Illinois 529 gifts when you plan how to use the cap.

Contributions below the cap leave state-tax savings on the table. Amounts above the ceiling still grow tax-free but give no Illinois 529 deduction. The contribution window closes at midnight on December 31; Illinois offers no January grace period.

Visual guide to hitting the Illinois 529 $10,000 and $20,000 deduction caps before the December 31 deadline.

Practical ways to stay on track:

-

Set a recurring transfer of $834 each month so 12 deposits land right at $10,000.

-

Make a December “top-off” once you know your cash flow.

Couples should coordinate, because the $20,000 limit applies to the return, not to each spouse. One person can contribute the full amount, or you can split it; either way the household enjoys the same break.

Working with a windfall? Deposit $10,000 on December 29 and another $10,000 on January 2. This move secures two years of deductions, worth up to $990 each year at the 4.95 percent rate, without adding extra cash.

Save the confirmation email or year-end statement. You will report the total on Schedule M, Line 13 when you file. Hit the cap, claim the savings, repeat next year.

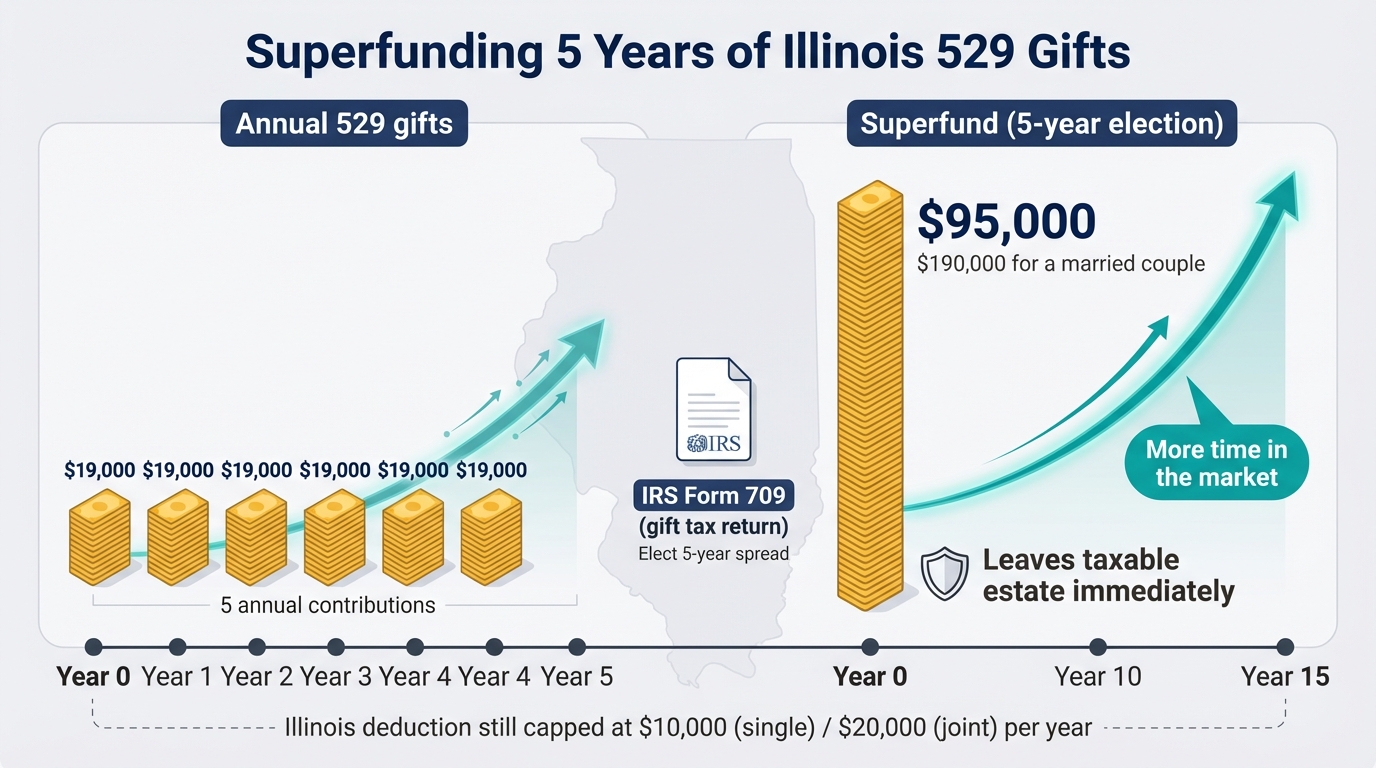

Smart way #3 – “superfund” up to five years of gifts at once

The IRS lets you front-load up to five years of annual gift-tax exclusions into an Illinois 529 in a single calendar year, a move Bright Start 529’s complete guide to 529 college savings plans calls the five-year election. In 2025 the exclusion is $19,000 per recipient, so you can contribute:

Superfunding five years of Illinois 529 gifts at once can provide more time in the market than annual contributions.

-

$95,000 as an individual

-

$190,000 as a married couple that elects gift-splitting

Source: IRS gift-tax FAQ table of annual exclusions (irs.gov).

Why consider a lump sum?

-

More time in the market. A $95,000 deposit compounding for 15 years generally outpaces five $19,000 deposits spread across five years.

-

Estate planning. The contribution leaves your taxable estate at once, provided you live beyond the five-year window. This timing can help wealthy families before the federal estate exemption is scheduled to fall in 2026.

-

Administrative simplicity. One transfer and one Form 709 reduce paperwork.

Trade-off for Illinois taxpayers

Illinois still caps the deduction at $10,000 (single) or $20,000 (joint) in the year you contribute. Dollars above that ceiling grow tax-free but earn no Illinois credit. If maximizing the state break matters, stagger contributions.

Paperwork checklist

-

File IRS Form 709 by April 15 of the year after the contribution to elect the five-year spread; if you skip the form, the full gift counts this year (irs.gov).

-

Keep the 529 confirmation statement; Illinois may ask for proof of the deductible amount.

When superfunding makes sense

This tactic shines when you have excess cash, want the longest tax-free growth window, or need to trim a future estate. If those conditions fit, a single afternoon of paperwork can lock in decades of education funding.

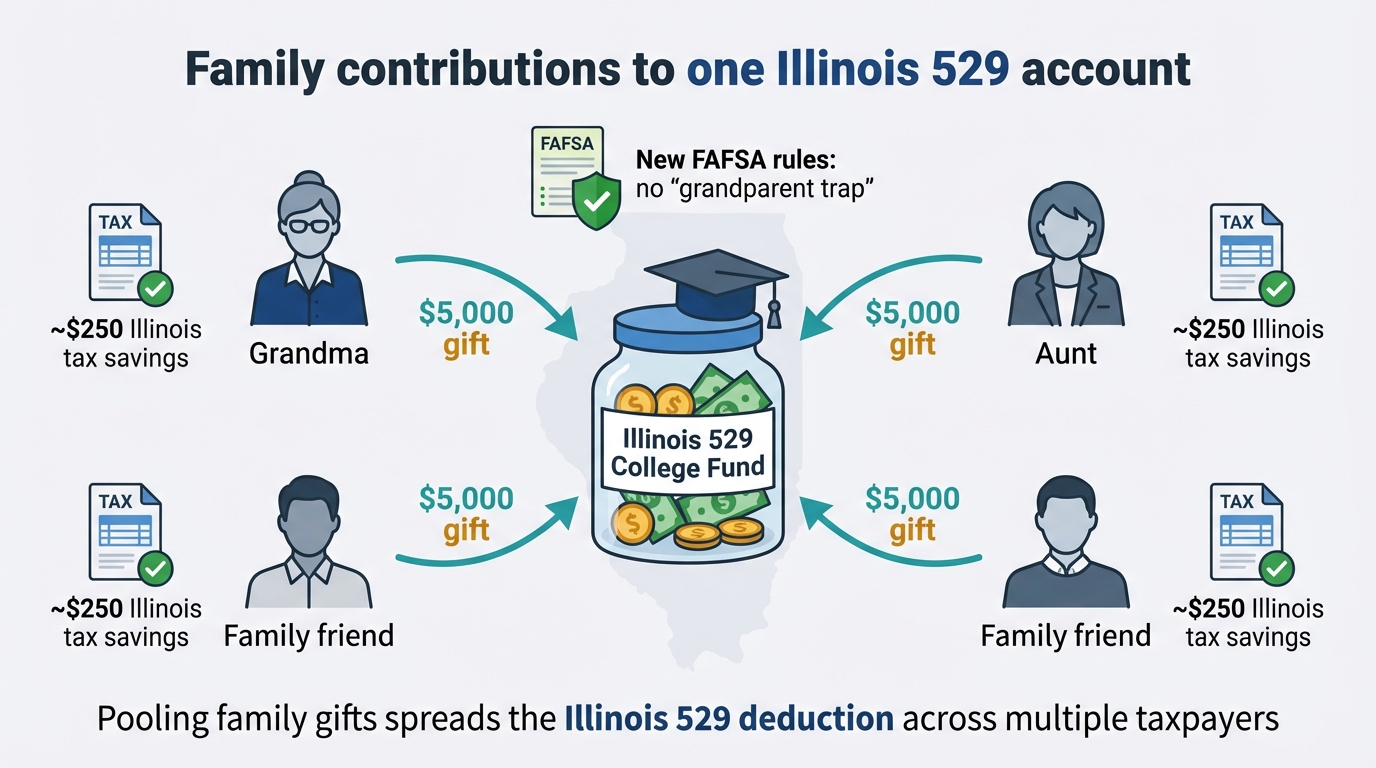

Smart way #4 – recruit family members and multiply the deduction

Illinois treats every resident contributor as a separate taxpayer. If Grandma, an aunt, and two family friends each deposit $5,000 into the same Bright Start account, the student gains $20,000 for college and each giver subtracts $5,000 on their own IL-1040, about $250 back at the 4.95 percent rate (tax.illinois.gov).

When multiple Illinois relatives contribute to the same 529 account, each can claim their own state tax deduction under the updated rules.

FAFSA update removes the old “grandparent trap”

Starting with the 2024–25 form, distributions from a grandparent-owned 529 are not counted as student income, thanks to the FAFSA Simplification Act (savingforcollege.com). Relatives can now help pay tuition without harming need-based aid.

Simple gifting mechanics

-

Send a contribution through Bright Start’s Ugift portal; the system emails a receipt you can keep for taxes.

-

Prefer a paper check? Make it payable to the 529 plan and write the account number in the memo so the plan records your name.

-

Aim to contribute by December 15 to guarantee same-year posting on the year-end statement.

Pooling family dollars does more than enlarge the account; it spreads the Illinois 529 deduction across several returns and makes college funding a group win.

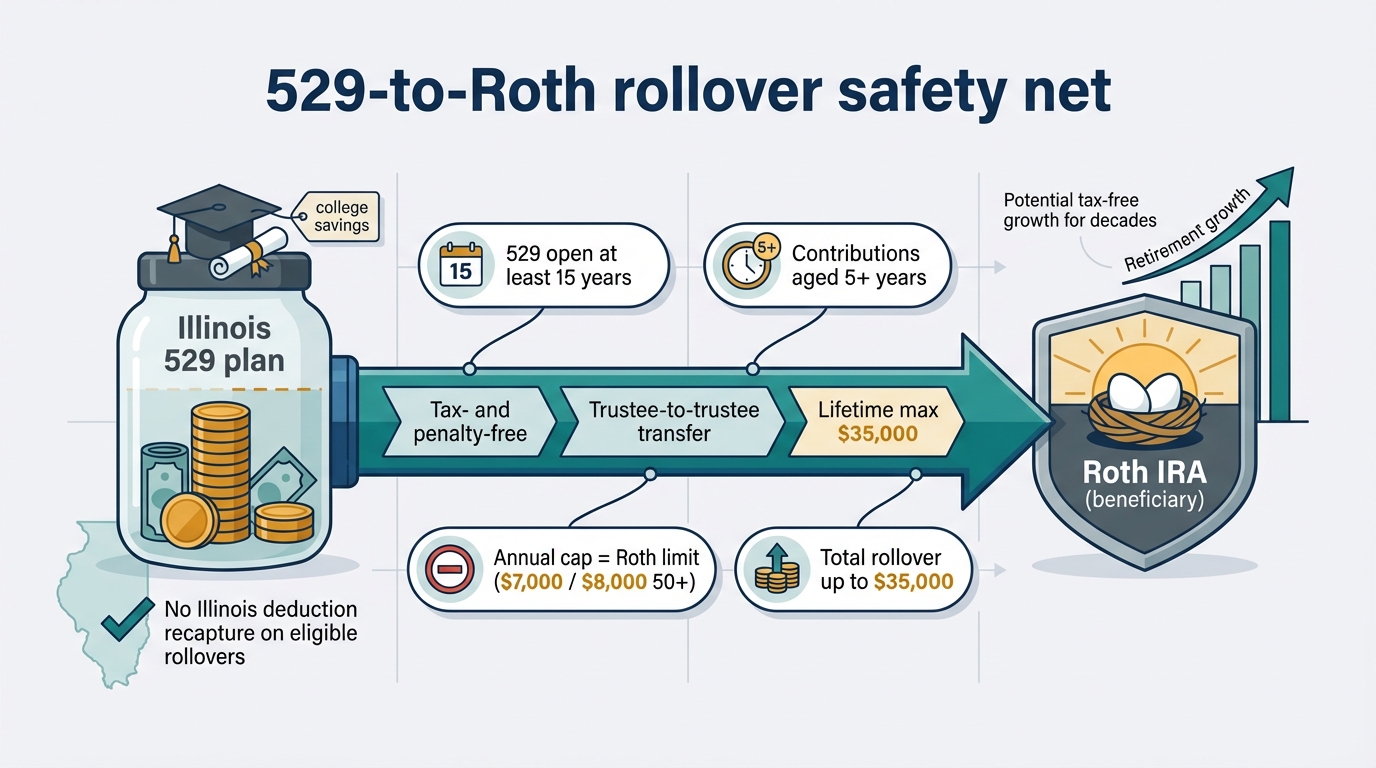

Smart way #5 – use the new 529-to-Roth rollover as a safety net

Secure 2.0 created a fallback for unused college funds. Beginning with the 2024 tax year, you may move up to $35,000 in leftover 529 money, tax and penalty free, into a Roth IRA owned by the beneficiary (irs.gov, savingforcollege.com).

Secure 2.0 allows unused 529 funds to roll into a beneficiary’s Roth IRA, giving college savings a second life as retirement money.

Key rules at a glance

-

15-year account age. The 529 must be open for at least 15 years.

-

5-year seasoning. Contributions and their earnings must stay in the plan at least five years before transfer.

-

Annual cap equals the Roth limit. Each year’s rollover counts toward the regular Roth ceiling, $7,000 for 2025 (or $8,000 if the beneficiary is 50+).

-

Lifetime cap. One beneficiary can roll over a total of $35,000.

-

Trustee to trustee only. The funds must move directly from the 529 plan to the Roth custodian.

Illinois confirms that Bright Start and Bright Directions rollovers do not trigger deduction recapture, so prior Illinois 529 deduction savings stay intact (2024 Treasurer release).

How this pairs with earlier tactics

-

Max the $10,000 / $20,000 Illinois 529 deduction each year.

-

Superfund confidently. If you overshoot tuition, redirect up to the Roth limit each year and give the graduate an early retirement boost.

With this rollover option in place, aiming higher on 529 contributions often rewards you: even extra dollars can grow tax-free for another 40 years.

Frequently asked questions

Who can claim the Illinois 529 deduction?

Any Illinois resident who contributes to Bright Start or Bright Directions may subtract up to $10,000 (single) or $20,000 (joint) from state taxable income (tax.illinois.gov).

Do I have to own the account to deduct my gift?

No. The deduction follows the dollars, not the account title. If your name appears on the contribution record (through Ugift or a personal check), you can claim the subtraction.

Can I carry unused deduction room into the next year?

Illinois offers no carry-forward. Contributions above the annual cap still grow tax-free, but they lose the state break. Spreading large gifts across calendar years is the only workaround.

How do I claim the deduction at tax time?

Enter your eligible total on Schedule M, Line 13 of Form IL-1040, and keep the year-end statement or email receipt as proof.

Will grandparent-owned 529 withdrawals hurt financial aid?

No. The FAFSA Simplification Act removes that penalty starting with the 2024–25 FAFSA; such withdrawals are no longer counted as student income.

What if we don’t use all the money for college?

Secure 2.0 permits up to $35,000 of leftover funds to move, tax-free, into the beneficiary’s Roth IRA (subject to a 15-year account age and annual Roth limits). Illinois will not recapture prior deductions on these rollovers.

Does rolling another state’s 529 into Bright Start earn a deduction?

No. Rollovers are not treated as new contributions, so they produce zero Illinois 529 deduction. Only fresh money qualifies.

Conclusion

With the right strategy, Illinois families can secure the maximum state deduction each year, grow college savings faster, and still keep flexibility for unused funds—all while helping loved ones share in the tax benefits.